Insights A Closer Look: U.S. Federal Reserve and Interest Rate Policy

Date: 8/5/2025

Authors

Jerry H. Tempelman, CFA

Vice President, Economic and Fixed Income Research

The U.S. Federal Reserve left short-term interest rates unchanged at its monetary policy meeting on July 29–30. According to the Federal Open Market Committee (FOMC) statement, “growth of economic activity moderated in the first half of the year.” However, the statement added, “[t]he unemployment rate remains low,” and “[i]nflation remains somewhat elevated.” During the post-meeting press conference, Fed chair Jerome Powell called the current stance of monetary policy only “modestly restrictive.” Some key points he made are illustrated by recent data releases in the following areas of focus.

1. Gross Domestic Product

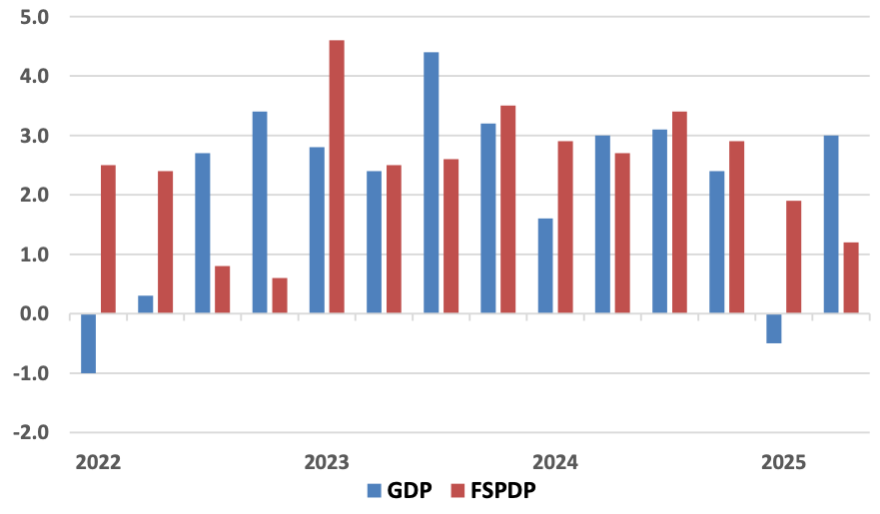

GDP was recently reported at +3.0% for the second quarter, a welcome increase from the -0.5% reported for the first quarter (Fig. 1). However, GDP data have lately been distorted. In the first quarter, imports were unusually high, as companies dependent on foreign suppliers tried to avoid the impact of upcoming tariffs. Imports, which are not produced domestically, count as a subtraction in the calculation of GDP. This pull-forward was offset by unusually low imports the next quarter.

One way to correct for this distortion is to consider only subsets of total GDP, such as final sales to private domestic purchasers (FSPDP), which leave out imports and exports, as well as government and inventory data. This metric declined from +1.9% to +1.2% from the first quarter to the second. Looking at both GDP and FSPDPs, overall macroeconomic activity was probably not as weak in the first quarter as suggested by the official GDP numbers, but not quite as strong in the second quarter either.

Fig. 1. GDP, Final Sales to Private Domestic Purchasers (annualized, QoQ, %)

Source: Bureau of Economic Analysis

2. Inflation

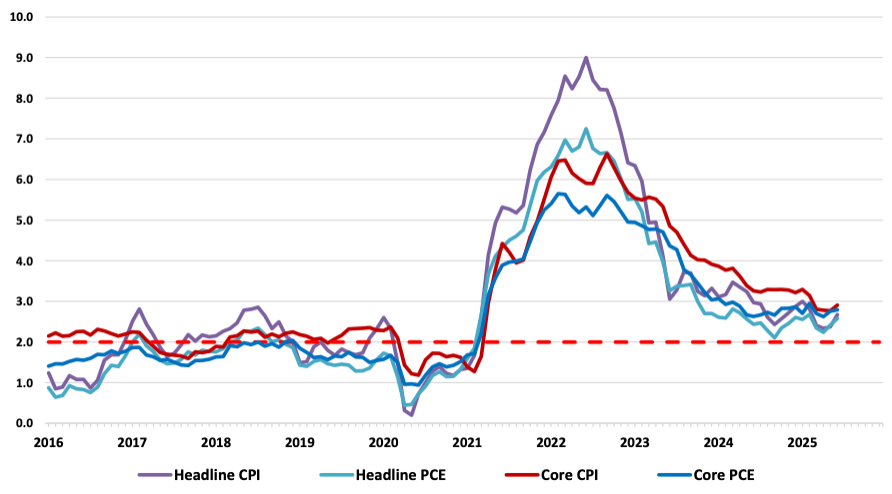

Recent data indicate that inflation is not yet contained. Admittedly, inflation has declined significantly from the sky-high levels set in 2022. However, for more than a year now, inflation has ranged between roughly 2.5% and 3.0%, depending on which measure one uses (Fig. 2). This remains well above the Fed’s 2.0% target level, and above what most consumers would consider price stability. The trend in recent months has moved in the wrong direction for both the Consumer Price Index and the Personal Consumption Expenditures Price Index, and for both the headline and core versions of these indices.

There is no widespread agreement among economists regarding how low inflation should be to represent price stability. Former Fed chairs Paul Volcker and Alan Greenspan used to say that inflation should be low enough that consumers and entrepreneurs don’t take it into consideration in their spending and investment decisions. Mr. Powell concurred with this definition of price stability earlier this year. Given the attention that inflation continues to receive, it is a stretch to argue that prices are now stable.

Fig. 2. Year-over-year change in inflation (%)

Sources: Bureau of Economic Analysis; Bureau of Labor Statistics

3. Unemployment

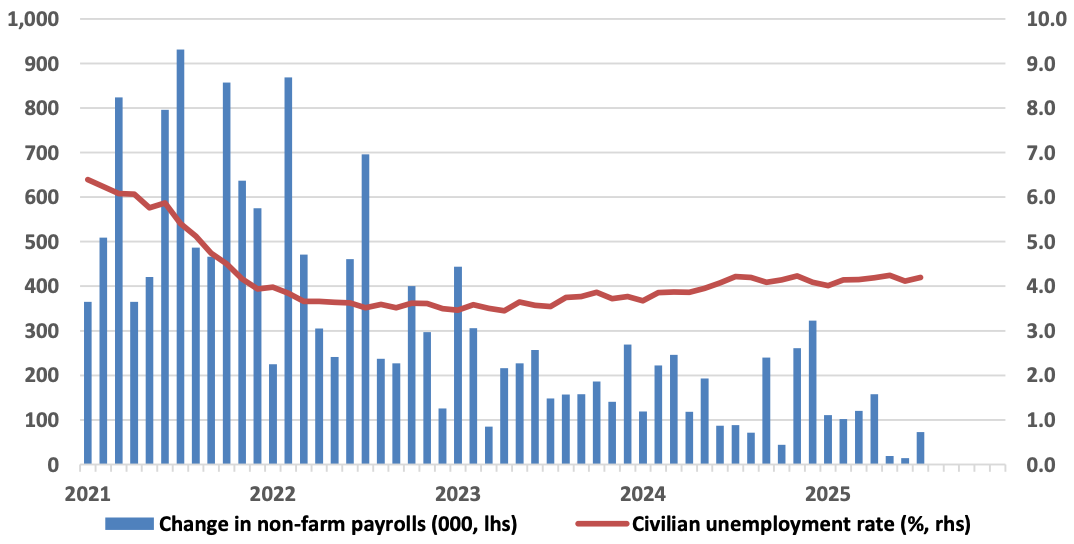

The principal reason for the dissenting Fed votes in July was weakness in recent employment data. Job growth has been disappointing in recent months, especially so in the private sector (Fig. 3). Weakness in employment last year is what prompted the Fed to lower short-term interest rates three times.

It is not impossible that the recent lackluster job growth numbers are due to a softening in the supply of labor rather than the demand for it, which would explain why the unemployment rate continues to be low by historic standards. In addition, data revisions were quite large in recent months, and recent data are likely to be revised yet again in the future.

Fig. 3. Employment

Source: Bureau of Labor Statistics

Outlook

Financial markets were clearly disappointed that the Fed did not signal it would be lowering short-term rates at its next meeting, in September. But given that two full monthly updates of inflation and employment statistics are published between the July and September meetings, the lack of a decision regarding future policy should not have come as a surprise.

In response to the Fed’s July decision and recent inflation data, futures markets are now pricing in a roughly 85% probability of a quarter percentage rate cut in September, and a second cut before year-end. This is more or less what the Fed projected at the beginning of the year. Upcoming data releases over the coming months are likely to provide greater clarity about the overall direction of the economy, and narrow the differences among various Fed officials with respect to the course of monetary policy.

Jerry H. Tempelman is Vice President of Fixed Income Research at Mutual of America Capital Management LLC where he is a credit analyst of financial institutions (banks, insurance companies, real estate investment trusts) with the Company. Previously, he was a credit strategist with Moody’s Analytics, and a Senior Financial and Economic Analyst with the Federal Reserve Bank of New York.

The views expressed in this article are subject to change at any time based on market and other conditions and should not be construed as a recommendation. This article contains forward-looking statements, which speak only as of the date they were made and involve risks and uncertainties that could cause actual results to differ materially from those expressed herein. Readers are cautioned not to rely on our forward-looking statements.

The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. Mutual of America is not responsible for any subsequent investment advice given based on the information supplied.

Mutual of America Capital Management LLC is an indirect, wholly owned subsidiary of Mutual of America Life Insurance Company. Insurance products are issued by Mutual of America Life Insurance Company, 320 Park Avenue, New York, NY 10022-6839. Mutual of America Securities LLC, Member FINRA/SIPC distributes securities products. Mutual of America Retirement Services LLC provides administrative and recordkeeping services. Mutual of America Financial Group is the trade name for the companies of Mutual of America Life Insurance Company.