Insights A Closer Look: U.S. Credit Rating Downgrade

Date: 5/22/2025

Authors

Jerry H. Tempelman, CFA

Vice President, Economic and Fixed Income Research

Key Takeaways

- Moody’s expresses concern about direction of U.S. fiscal path.

- Consumers unlikely to feel any impact on borrowing costs.

- Interest on federal debt is now largest expense item of federal government and projected to grow.

- Downgrade unlikely to have meaningful effect in long term on U.S. Treasury yields or economy.

On Friday, May 16, after the market close, the ratings firm Moody’s downgraded its credit rating of the United States by a single notch, from Aaa to Aa1. The action wasn’t a complete surprise, as Moody’s had changed its outlook on the rating to negative in 2023. That same year, Fitch had also downgraded the U.S. In 2011, Standard & Poor’s had downgraded the U.S. and Moody’s changed its outlook to negative, but returned it to stable two years later.

U.S. Treasury bond yields were largely unchanged after markets opened on Monday. It is unlikely that consumers will feel any impact on borrowing costs, given that interest rates on U.S. debt are unlikely to be affected by the downgrade

What’s Driving the Downgrade?

Coming off the Great Recession, in 2011 rating agencies’ greatest concern was the institutional resilience of the U.S. federal government, given budget standoffs, debt ceiling negotiations and the prospect of default—however short-lived. This time, however, rating agencies are more concerned about the direction of the U.S. fiscal path. As Moody’s explained its rationale for the downgrade:

“Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs. We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

Interest on Federal Debt Projected to Grow

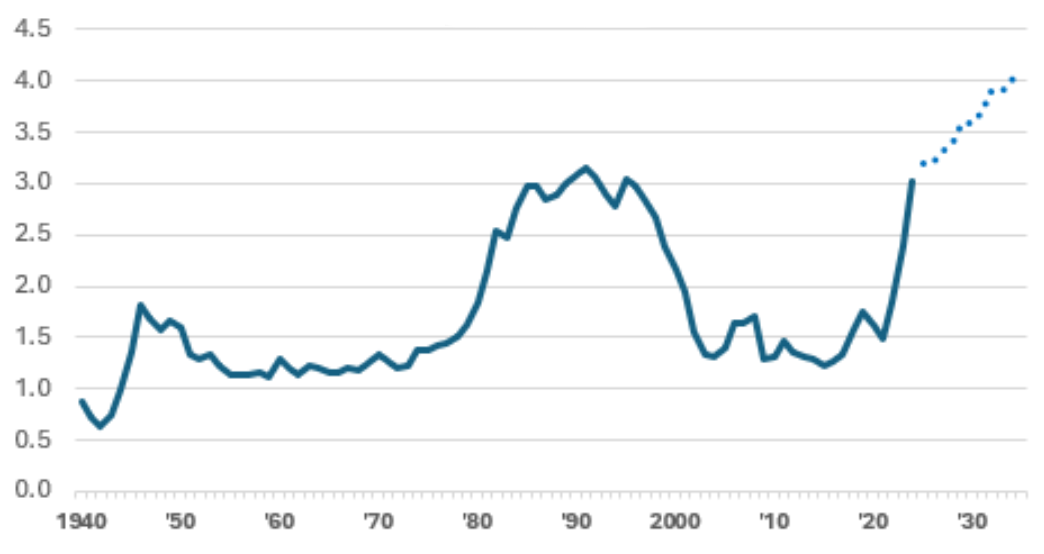

A look at the data shows that such concern is not entirely misplaced. Interest on the federal debt made up 3% of U.S. Gross Domestic Product (GDP) in the most recent fiscal year, and is projected by the bipartisan Congressional Budget Office to grow to 4% over the next 10 years. Interest on the federal debt is now the largest expense item of the federal government.

Interest on U.S. federal debt as % of GDP

Sources: FRED St. Louis, CBO (projections). Data as of 12/31/2024.

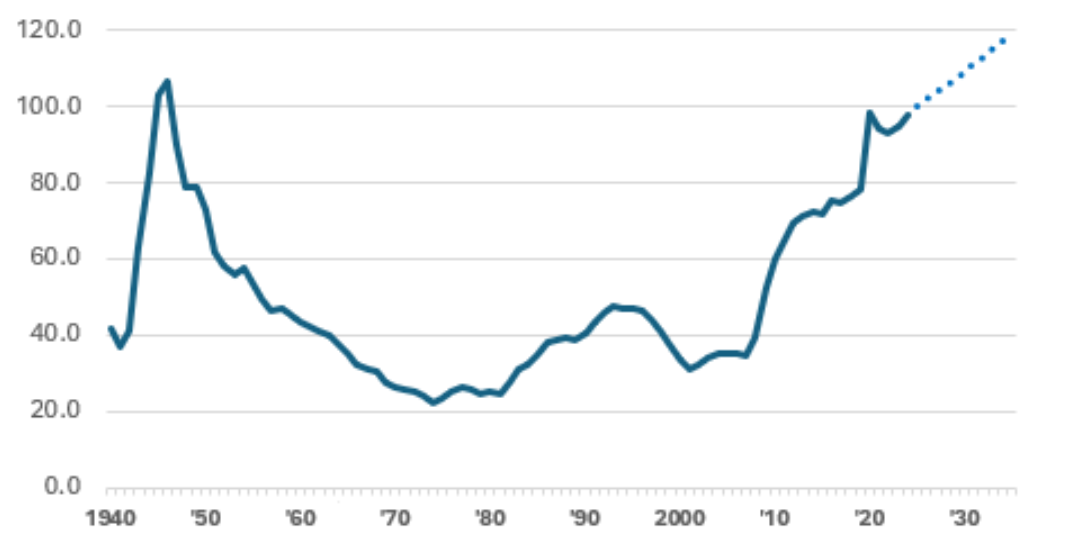

Publicly held debt currently accounts for roughly 100% of U.S. GDP, and is projected to increase, in part because of ever-increasing shortfalls in entitlement programs, such as Social Security and Medicare. Public finance literature, which covers the academic study of the government’s financial activities, generally holds that once this metric reaches 90% it begins to have a negative impact on economic growth (for emerging markets it’s 60%). Admittedly, the United States may be a special case, immune from such general rules of thumb.

Publicly held federal debt as % of GDP

Sources: FRED St. Louis, CBO (projections). Data as of 12/31/2024.

Outlook

In short, the rating downgrade itself is unlikely to have any meaningful effect in the long term on U.S. Treasury yields or, more broadly, the U.S. economy. But the fiscal projections on which the downgrade is based are not encouraging.

Jerry H. Tempelman is Vice President of Fixed Income Research at Mutual of America Capital Management LLC where he is a credit analyst of financial institutions (banks, insurance companies, real estate investment trusts) with the Company. Previously, he was a credit strategist with Moody’s Analytics, and a Senior Financial and Economic Analyst with the Federal Reserve Bank of New York.

The views expressed in this article are subject to change at any time based on market and other conditions and should not be construed as a recommendation. This article contains forward-looking statements, which speak only as of the date they were made and involve risks and uncertainties that could cause actual results to differ materially from those expressed herein. Readers are cautioned not to rely on our forward-looking statements.

The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. Mutual of America is not responsible for any subsequent investment advice given based on the information supplied.

Mutual of America Capital Management LLC is an indirect, wholly owned subsidiary of Mutual of America Life Insurance Company. Insurance products are issued by Mutual of America Life Insurance Company, 320 Park Avenue, New York, NY 10022-6839. Mutual of America Securities LLC, Member FINRA/SIPC distributes securities products. Mutual of America Retirement Services LLC provides administrative and recordkeeping services. Mutual of America Financial Group is the trade name for the companies of Mutual of America Life Insurance Company.